Without a doubt, Shopify and Square are two commerce giants. Both are all-in-one merchant solutions that offer a comprehensive range of software and hardware tools – from e-commerce store builders to POS systems.

Thanks to those tools, merchants can run their day-to-day operations smoothly regardless of whether they own an online or brick-and-mortar store. All this means that a Shopify vs. Square comparison, like ours here, is one that truly makes sense.

From what we’ve said, it’s apparent that Square and Shopify are very similar. All those shared features and similarities can leave many users wondering how to choose between them. It’s a real dilemma many merchants and entrepreneurs could face when considering these two business solutions.

On that account, in this Shopify vs. Square review, we aim to make choosing between the two industry giants as easy as possible. So, if Shopify and Square have grabbed your interest, but you want to know more, this should be helpful.

Now, buckle up and join us on our investigation into two of the most prominent commerce platforms on the market.

| Quick guide: | ||

| Shopify | Square | |

| Pricing |

|

|

| Integrations |

|

|

| Store builder |

|

|

Table of Contents

Pricing

The Shopify Pricing System

You’ll find pretty specific pricing information on Shopify’s official website, but let’s briefly go over their system.

Three Standard Pricing Plans

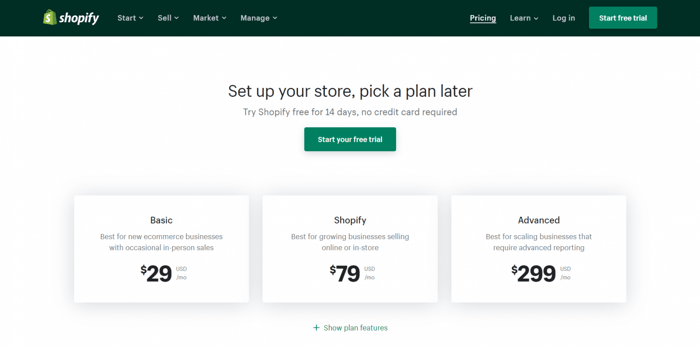

According to the information above, there are three standard pricing plans, which are the following:

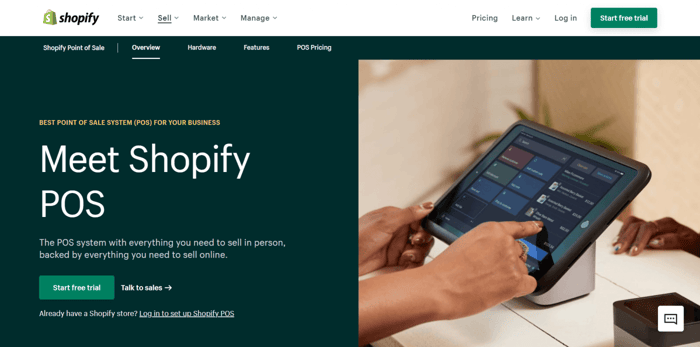

As the short descriptions above indicate, each pricing plan allows you to sell online in an e-commerce store and on-site in a brick-and-mortar store. That means that, in addition to various e-commerce features, all three pricing plans include the famous Shopify POS (point of sale) system.

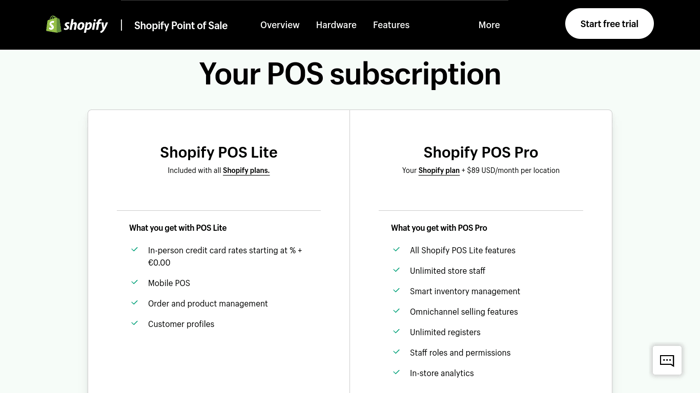

The Shopify POS comes in two flavors: Lite and Pro. The Lite version is the one included in the standard plans. You can also use the Pro version, but that will cost you an extra $89/month per location.

Regarding e-commerce features, their quantity and level (more or less advanced functions) depend on the plan. As expected, the more expensive the pricing plan, the more advanced the features. Let’s look at a small selection of features of the prominent pricing plans.

Main Shopify Plans’ Features

Shopify offers so many features that we’re only going to highlight the few noteworthy ones of each plan. Any good e-commerce solution like Shopify will offer essential e-commerce features like a store builder or the ability to build product catalogs. That’s why we’ll leave out fundamental tools like these two from our lists.

With that in mind, some of the most prominent features of the three standard Shopify pricing plans are the following:

- The Basic plan:

- Multichannel sales – the possibility to sell on social media like Facebook and online marketplaces like Amazon.

- Marketing automation – the ability to automate marketing emails to customers based on external triggers, like a new signup.

- Abandoned cart recovery – the ability to increase chances of recovering abandoned checkouts by sending non-pushy reminders to customers.

- Inventory locations – the possibility of managing, stocking, and tracking inventory in multiple places.

- Localized user experience – currency conversion, website language translation, geographic-based market domains, and similar features that make for a great local buyer experience.

- The Shopify plan:

- Standard reports – sales, retail, order, customer, and profit reports unavailable with the Basic plan.

- USPS Priority Mail Cubic pricing – available only to US-based merchants.

- The Advanced plan:

- Advanced reports – develop customized sales reports.

- E-commerce automation – the ability to create automated workflows and apply them in different contexts.

- Additional international commerce features – for instance, the ability to customize your pricing according to a given geographic location.

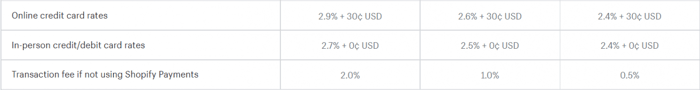

Card Rates and Transaction Fees

Card rates and transaction fees are often seen as hidden costs that can really impact your decision-making process. People want to know what they’re paying for in advance.

Two things are important:

- Credit and debit card rates for both online and in-person payments.

- Transaction fees for customers who don’t use Shopify’s native payment system, Shopify Payments.

Instead of talking at length, we’ll let the following table tell the essential information about the card rates and transaction fees on Shopify:

As a reminder, all card companies will charge fees for their service. They’re universal, regardless of which commerce software solution you choose. Instead of charging a fixed up-front fee, card companies take a small cut every time a customer pays using a credit or debit card. Therefore, card transaction fees are linked to your bank and not the platform itself.

As far as transaction fees for not using Shopify Payments, Shopify charges them in two scenarios:

- When a Shopify client intentionally chooses to use another payment gateway for one reason or another.

- When a Shopify client resides in a country where Shopify Payments is not supported.

The first case is self-explanatory, but the second requires some more detail.

Understandably, Shopify Payments is Shopify’s preferred payment gateway. However, the problem is that not everyone has access to it, as only 17 countries and regions are eligible for Shopify Payments.

In addition to this, not every company can use Shopify Payments. Clients need to meet specific bank account requirements to be eligible for the payment gateway.

Currency Conversion Fee

As the name clearly suggests, the currency conversion fee is the amount that Shopify charges when converting a sum from one currency to another. More specifically, the charges apply if the received payment currency is “different from your payout currency.”

The currency conversion fee is different for US and non-US users. If your store is US-based, the currency conversion fee is 1.5%. For stores registered outside of the US, the fee is 2%.

There are two things to keep in mind about the currency conversion fees:

- The numbers above apply to stores that use Shopify Payments as a payment gateway.

- Based on Shopify’s information on currency conversion fees, your customer pays the cost, not you as the store owner.

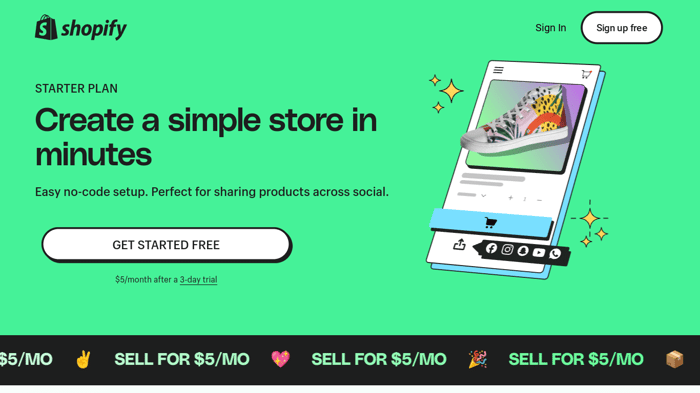

Shopify Starter

Shopify Starter is a unique, non-standard pricing plan that costs only $5/month. It caters to users who want access to some of Shopify’s great features without necessarily needing to create a full-blown online store.

It’s perfect for those that want to start small, selling on social media platforms and scaling up as their business develops.

With this, you’ll get access to a simple Shopify storefront, Shopify checkout management, Shopify apps, and unlimited product pages. The biggest selling point is that you can get your business started very easily – even with a smartphone.

You can choose to upgrade your plan later when your business has developed a solid customer base. Take a look at the Shopify Starter page to learn more about this terrific Shopify plan.

Shopify Plus

Shopify Plus is not just a pricing plan. It’s virtually a distinct commerce platform developed by Shopify and geared toward large businesses and enterprises.

As is often the case with enterprise platforms and pricing plans, Shopify Plus has custom pricing. According to this platform’s website, the least you’ll pay for Shopify Plus is $2,000/month. However, the price can go higher depending on your business size and needs and your custom requests.

If your business fits the description of a high-volume enterprise business and you’re eager to learn more about Shopify Plus, check out this Shopify Plus review.

Shopify Free Trial

Last but not least, Shopify offers a 14-day free trial. It doesn’t require your payment information, which is fantastic.

Another terrific thing about the free trial is that you can extend it indefinitely. To do that, you need to choose to create a new store when your trial ends. That will restart your free trial and allow you to continue testing Shopify until you’re sure it’s a good solution for you.

The only drawback to extending the trial is that you won’t be able to publish any of your e-commerce stores. Nonetheless, since the whole point of a free trial is to allow you to test the software out, not publish websites, this is not much of a disadvantage.

The Square Pricing System

The Complex Square Pricing System

Square has a much more complex pricing system than Shopify. The main reason for this is the complex nature of the platform itself. In essence, Square is not just an e-commerce platform; it’s a conglomerate of multiple platforms directed toward different customer types that provides a large assortment of functionalities.

As an illustration, if you click “Products” on Square’s official website, you’ll see that Square comprises five different modules:

- Commerce – enables you to sell online and use the Square POS.

- Customers – covers messaging, marketing, and loyalty programs.

- Banking – lets you accept payments, gain access to your funds, and take out loans.

- Staff – allows you to set permissions, manage employee benefits, and provide payroll services.

- Developer – enables you to integrate third-party software or develop new apps.

Despite its complex nature, we can provide some essential information on the Square pricing system.

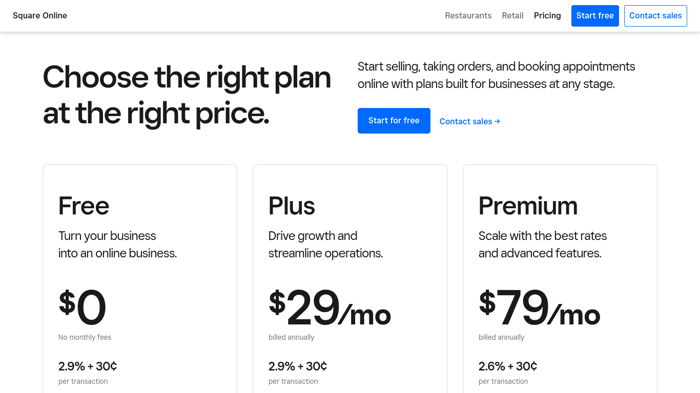

Square Online Pricing Plans

The following picture shows the three Square Online pricing plans, along with some basic information about their features:

Square Point of Sale Fees

The Square POS system is free. There are no upfront, monthly, or annual costs you pay to use either the Square POS software or the hardware that comes with it. However, that doesn’t mean that there aren’t additional fees.

The good news is that they’re minimal and Square charges you only when you make a sale. This is how much you pay per transaction:

It’s worth noting that Square may offer you a custom deal if your company makes over $250K in sales processed with the Square POS system. Another requirement is that your average ticket size (average sale amount per customer) should be more than $15.

There are additional eligibility criteria, but you need to contact the Square sales team for more detail, as with any custom pricing deal.

Square Card Payment Processing Fees

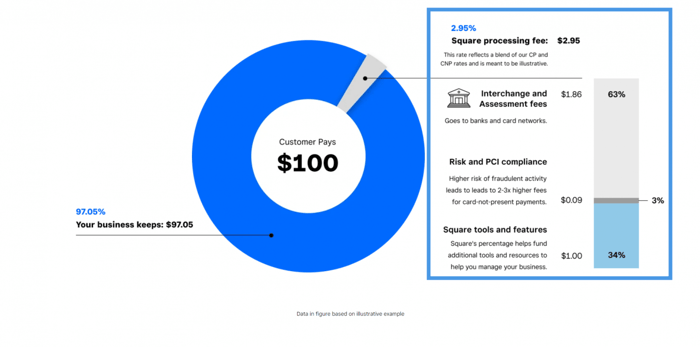

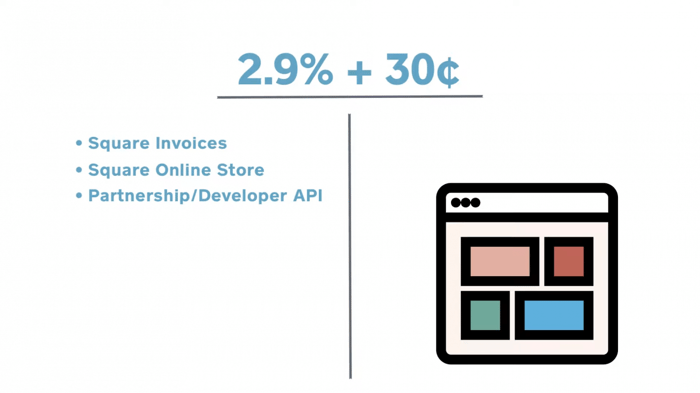

The Square card payment processing fees are composite. They consist of three different parts visually explained in the following image:

The highlighted part on the right shows the three constituent parts of a Square card payment processing fee:

- Interchange and assessment cost

- Risk and PCI compliance cost

- Square tools and features cost

The interchange and assessment cost is that portion of the overall transaction fee amount banks and card networks take for their services. The interchange part goes to your customers’ banks (where they get their cards), while the assessment is paid to “card networks.”

Card networks is an alternative term for the companies that issue credit and debit cards, such as Visa, Mastercard, AmericanExpress, and Discover.

Finally, the third portion goes to a fund Square uses to invest in fraud protection, advanced analytics and reporting tools, dispute management services, inventory management features, etc. In short, it allows Square to work on service and product upgrades and updates.

Despite all the costs involved, the card payment transaction fees on Square make up only about 3% of your earnings per sale. Even though your expenses on Square can add up over time, 3% is not exactly the end of the world for what you get in return.

Note that when we say 3%, we mean 3% of the total processed amount. So, for instance, if someone leaves you a tip, Square will add this amount to your product price and charge you based on the entire sum – the base price plus the bonus.

Since Square allows you to accept cash and check payments, it’s worth noting that you don’t pay any fees for these two. When your customers pay in cash or checks, Square doesn’t need to process anything. It doesn’t record these payments, so there’s no reason to charge any transaction fees.

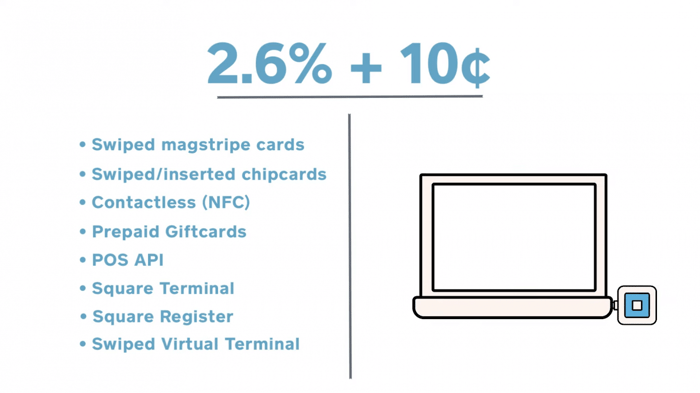

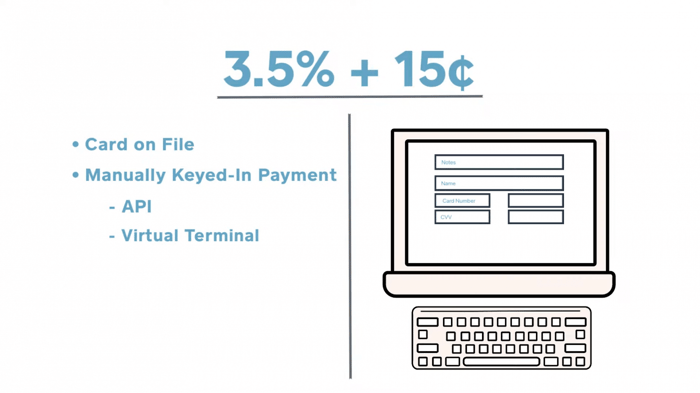

Card-Present and Card-Not-Present Fees

The previous subsection looked at card payment transaction fees from a general perspective. This one will provide more detail and explore the different categories of transaction fees you’ll encounter on Square.

We can divide the Square card payment processing fees into two main categories according to the card payment type:

- Card-present fees (in-person)

- Card-not-present fees (online transactions)

The following picture shows the different card-present transactions processed on Square, along with the card-present fee:

The card-not-present payments are made either by buyers entering their card information by hand or by buyers who reside at a physically remote location.

Based on this, the card-not-present fees are further divided into two subcategories:

- Fee for manually-entered transactions

- Fee for online payment transactions

As you have probably noticed, the card-not-present fees are higher than the card-present fees. The difference comes from the card-not-present payments being more vulnerable to security threats and abuse.

Those interested in more detail can check out the Learn About Square’s Fees article in the Square Support center.

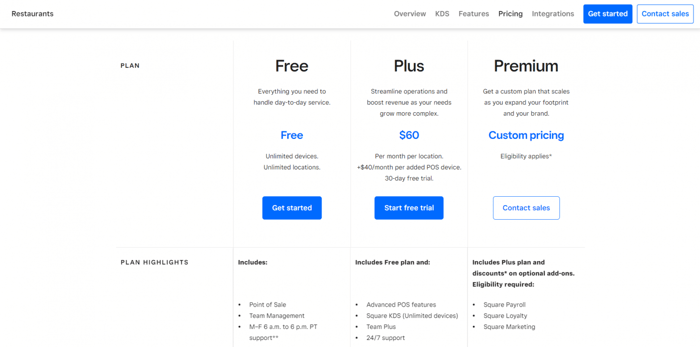

Square for Restaurants

We said earlier in this article that Square is a conglomerate of multiple platforms. Square for Restaurants is one of those platforms. As its name unambiguously shows, it was built exclusively for restaurants – all kinds of them.

Since this is a section on pricing, we won’t go in-depth on Square for Restaurants. However, this is one of the rare highly-integrated platforms that cater specifically to restaurant business owners.

These are the Square for Restaurants pricing options accompanied by short descriptions of each plan’s most prominent features:

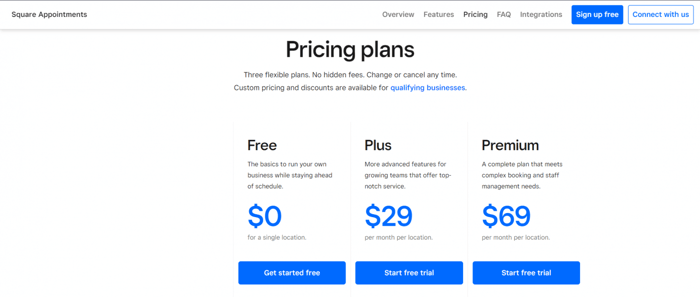

Square Appointments

Square Appointments is a booking and scheduling software system and tool. Some of the features it offers are the following:

- Online booking website

- Automated email and SMS reminders

- Google Calendar synchronization

- Multiple locations support

- Multiple time zones support

Thanks to features like these and many more, Square Appointments can be an appealing appointment solution for any business.

Square offers three Square Appointments pricing plans and a free trial. This is what they look like in a nutshell:

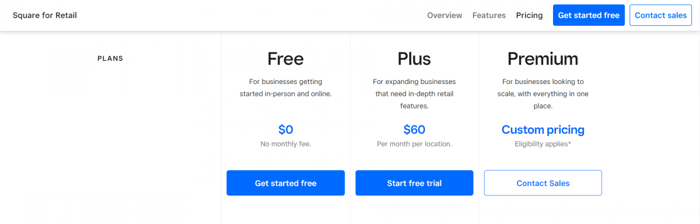

Square for Retail

Square for Retail is a Square app that enables integration between multiple aspects of your retail business, such as:

- Sales

- Inventory

- Purchase orders

- Customer directory

- Reports

To enjoy the perks of Square for Retail, you need to subscribe to one of three types of accounts:

Hopefully, that was sufficient to help you decide which pricing plan works best for you. Now, let’s move on to another crucial aspect of any e-commerce website builder – integrations.

Integrations

Shopify App Store

Shopify is well-known for its all-encompassing App Store. The Shopify App Store offers thousands of apps and integration possibilities. There’s hardly any commerce or e-commerce platform that can match what Shopify offers in this realm.

Shopify has grouped its official integrations into various batches to make it easier to find the type of app you need. Instead of browsing through a myriad of unsorted apps, select a category that best matches your business needs.

For instance, you can search within the group of:

- Most popular apps

- In-the-spotlight apps (integrations recommended by the Shopify team)

- Store design apps

- Marketing apps

- Apps that allow you to source and sell your products

- Apps made by Shopify

- Apps developed by celebrated app makers

- Conversion apps

- Shipping and delivery apps

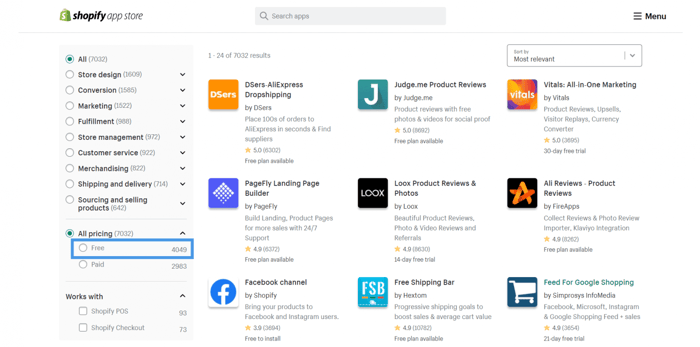

The good news for many entrepreneurs is that more than half of the Shopify integrations are either free or include a free plan.

As this image shows, out of over 7,700 apps, as many as 4,600 are free. How great is that? There’s virtually no way you won’t find the type of integration you’re looking for in the Shopify App Store.

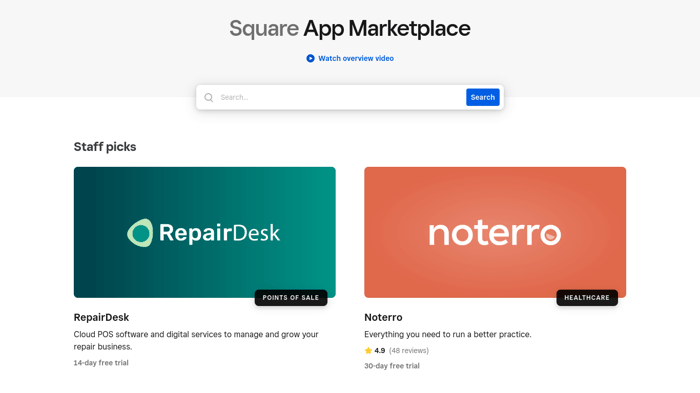

Square App Marketplace

The Square App Marketplace serves the same function as the Shopify App Store. Similar to its Shopify counterpart, the Square App Marketplace also features numerous integrations, although not as many as Shopify.

Like Shopify, Square has its official integrations sorted into multiple groups, categories, and collections. So, you have:

- Apps picked by the Square staff

- Most popular apps

- Featured collections

- Highest rated

- New apps

- Square Online add-ons

- Sixteen different categories, such as accounting & tax, marketing & analytics, e-commerce, etc.

- Several collections, for instance, contactless tools for service businesses and apps that work with Square Terminal

Again, similar to Shopify, a great deal of the apps in the Square App Marketplace are free or include a free plan. If the app you need is neither free nor offers a free account, it’ll provide at least a 14-day or 30-day free trial.

Which One Has Better Integrations: Square or Shopify?

As we can see, there’s not much separating Shopify and Square overall in terms of integrations. So, if integrations are among your top priorities, you can’t go wrong with either option.

However, if an abundance of choice is on your list of priorities, then Shopify does offer a greater selection compared to Square.

The company has attracted a large community of developers who constantly work on building and improving apps. Considering how popular Shopify is, we guess that this trend won’t stop soon. Shopify wins this time.

E-Commerce Store Builders

The Shopify Online Store Builder

In terms of aesthetics, design, and customization, Shopify is not exactly Webflow. Nonetheless, it still provides you with more than enough options to build a professional-looking and beautiful online store.

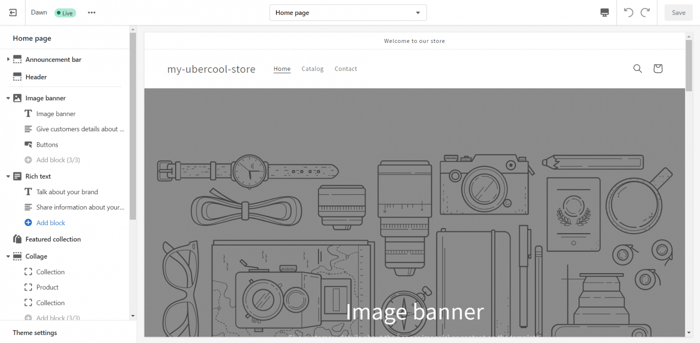

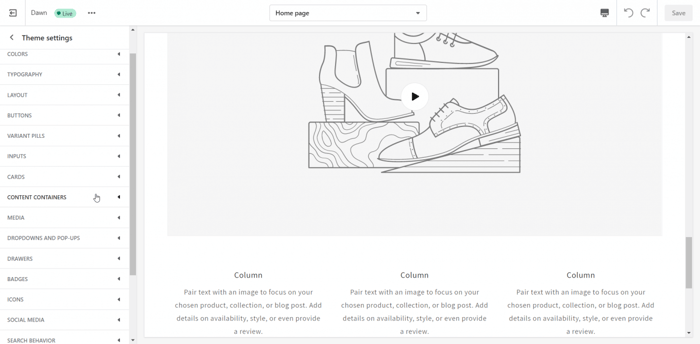

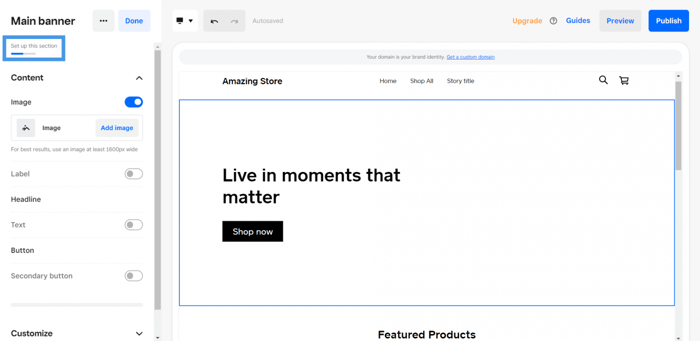

To see the Shopify builder in action, on your dashboard, find the store you want to work on and click “Customize.” Depending on your store theme/template, you’ll see something along these lines:

There’s plenty that you can do within the Shopify store builder. It’s almost impossible to expand on all the available possibilities without sending you to sleep. so we won’t even try to do that.

Instead, we’ll discuss some of the best features available and illustrate the range of customization options Shopify has to offer.

Reversing the order, we’ll start with the customization options. The following image shows part of what you see when you click “Theme settings” at the bottom of the builder:

In addition to all the editing possibilities on the left, you can set a:

- Favicon

- Currency format

- Checkout

- Theme style

Besides the theme settings, other notable features are the ability to:

- Access the Shopify App Store and add an integration directly from the builder.

- Edit your theme code.

- Preview your store on desktop and mobile devices.

A thing to keep in mind is that the Shopify builder is not drag-and-drop. Regardless, it’s still neat, quite intuitive, and easy to use.

Another important thing related to the Shopify store builder is themes – and Shopify has a lot of them. There are both free and premium themes, they’re all responsive, and they look terrific. But don’t take our word for that; check out the Shopify theme store and judge for yourself.

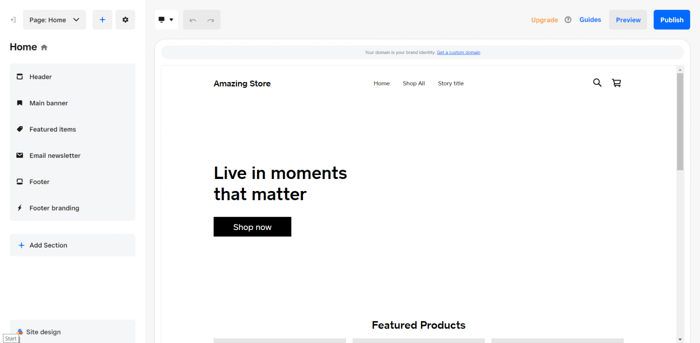

The Square Online Store Builder

The Square Online store builder is built on Weebly. As a reminder, Weebly is one of the most beloved website builders. After it acquired Weebly in 2018, Square decided to use its software solutions to create a separate site builder designed exclusively with e-commerce, online stores, and business websites in mind. That’s how Square Online was born.

Similar to Shopify, Square Online is not a drag-and-drop builder. If you want to add new parts to your pages, such as items or sections, you need to click the plus sign next to “Page: Home” (see the image above).

Adding new parts and content to your page is possible through the “Add Section,” too. In fact, this option leads to a treasure trove of exciting possibilities grouped in four clusters according to their purpose:

Sell more:

- Featured items

- Featured categories

- Donation

- Events

- Membership

- Featured menu items

- Instagram feed

Organize:

- Text

- Text and image

- Image gallery

- Button

- Video

- Embed code

Inform:

- About

- Customer testimonials

Communicate:

- Forms

- Email newsletter

- Location and hours

- RSS feed

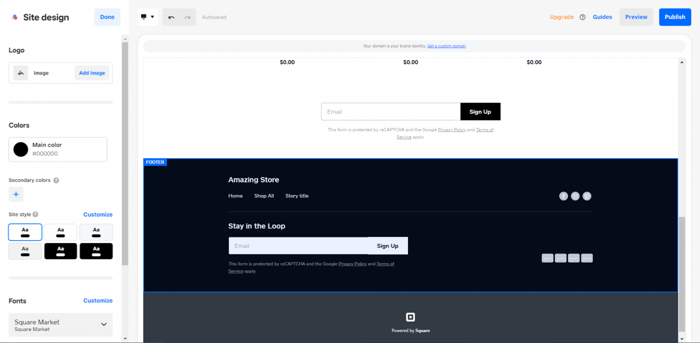

Customizability and design are not quite Square Online’s main fortes. Practicality, streamlined interface, and smooth synchronization with the rest of Square’s diverse suite of tools are areas where this site builder shines.

The settings button next to “+” lets you enter the page settings where, among other things, you can take care of your page SEO. Mousing over the options on the left sidebar allows you to move between different sections, while “Site design,” as you could have guessed, enables you to tinker with the page design.

Speaking of design, as we already mentioned, there’s not much you can change on your page aesthetics-wise. The following image shows some of the general site design options at your disposal:

Luckily, that’s not all the customization you can do in the Square Online store builder. Clicking inside individual sections displays more editing possibilities on top of the site design options.

Square Online doesn’t include a code editor, meaning you can’t make extensive advanced design or functionality modifications. However, the “Embed code” option does allow you to use code for customization and integration purposes.

As far as templates are concerned, Square has a separate website templates page where you can see some examples of its e-commerce designs.

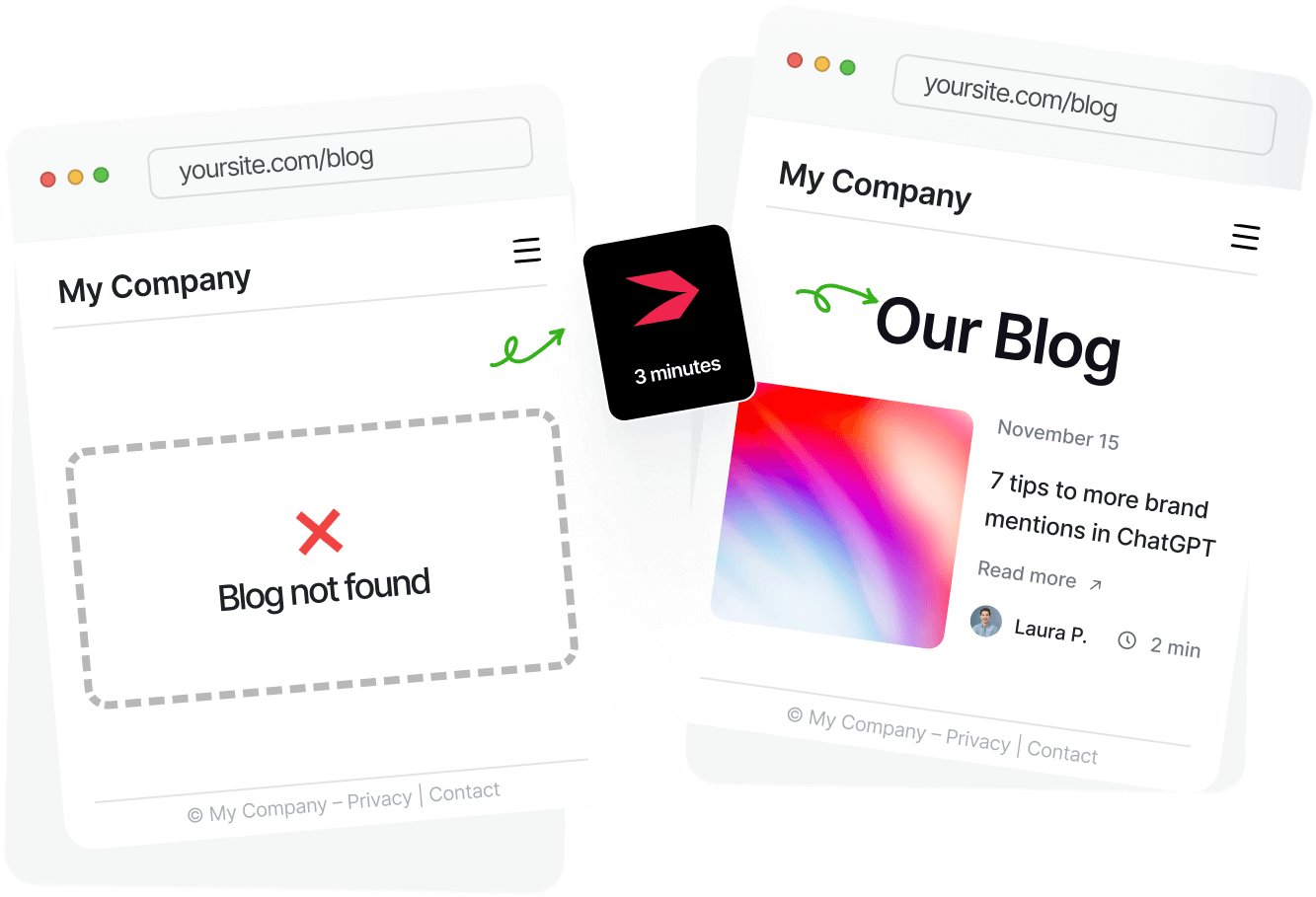

Blog

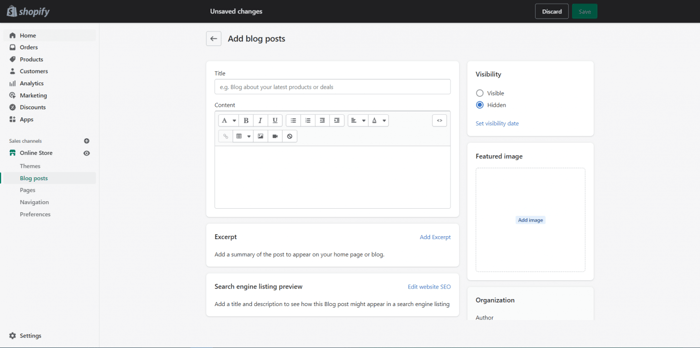

The Shopify Built-In Blog

There’s no better way than blogging to promote your brand, help your store rank higher on Google and other popular search engines, and boost high-quality traffic. With that in mind, Shopify has developed a native blogging solution. It’s built into the platform, and it’s available out of the box regardless of your subscription type.

Shopify allows you to do some tinkering when managing your blog. Some of the things you can do include:

- Set a blog post title and description.

- Customize your blog post URL.

- Add tags.

- Add a featured image.

- Add and display a post summary on your home or blog page.

A native blogging capability is a nice addition to Shopify. However, this platform does not revolve around blogging, which means that its blogging functionality is pretty basic.

Fortunately, Shopify allows you to add third-party apps made exclusively with blogging and SEO in mind. One such example is DropInBlog, but you can also search for more blogging apps in the Shopify App Store.

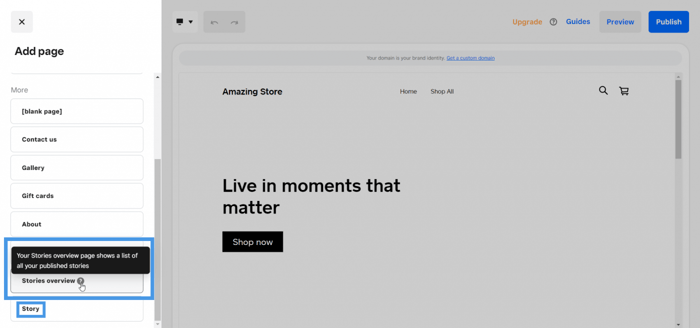

The Square Blog-Like Stories

In Square, the blog-like functionality “Stories” is accessible through the Square Online builder. Once you’re in the builder, you can get to “Stories” in a few clicks.

The first step is to click the plus sign that allows you to add a new section, page, item, or category. Click “Page,” then click “Show more” to see more menu items. That will show you two options, “Stories overview” and “Story,” both relevant for building a blog on Square.

As the concise description in the picture tells us, “Stories overview” displays all your published blog-like posts – or stories. As you could have already guessed, “Story” allows you to add a new post.

From the Square Online builder, you can:

- Set your story’s name and URL.

- Preview how your post will look in search results.

- Set SEO post page title and description.

- Add a social media image.

- Redirect URLs to your newly-created story/blog post page.

Similar to Shopify, Square allows you to create a blog on Square using third-party software, which might be a more straightforward option.

FAQs

What are some alternatives to Shopify and Square?

Amongst some of the best alternatives to both Shopify and Square would be Wix, WooCommerce, BigCommerce, and Zyro.

WooCommerce: Although technically not a standalone platform, WooCommerce is very popular. It’s connected to WordPress, which makes blogging easy, but you’ll have to pay for hosting on top of your subscription fees.

Wix: Wix is a really strong competitor when it comes to website design but doesn’t have quite as many specialized commerce capabilities.

BigCommerce: Considered easy to use and offers a good spread of features and abilities. A big plus is the excellent SEO capability.

Zyro: This website builder includes sufficient e-commerce functionality, and it’s super easy to use. In addition, the prices are definitely appealing to small businesses.

Which is easier to use, Shopify or Square?

While neither Shopify nor Square is a drag-and-drop website builder, one is definitely easier to use in many ways. Shopify has a very simple and user-friendly layout that makes its website builder much easier to get your head around. In addition to this, even other things like understanding the pricing system are much more straightforward.

Does Shopify take a cut of my sales?

Technically, yes. If you choose not to use Shopify Payments (the native payment system) and opt for a third-party payment system, you pay a fee per transaction. In this situation, you will pay 2%, 1%, and 0.5%, respectively, for the Basic, Shopify, and Advanced plan.

Does Square take a cut of my sales?

Similar to Shopify, Square also takes a small cut of your sales. Online payments will incur a fee of 30 cents plus 2.9% or 2.6% of the total sale price. Premium plan holders get slightly reduced transaction fees for online payments. The in-person transaction fee is 10 cents plus 2.6% of the sale price.

Over and Out

Shopify and Square are both enormous e-commerce platforms, so there’s a lot of ground to cover. In this Shopify vs. Square guide, we really only had room to cover the basics.

It’s clear that Shopify includes far more integration options and is probably superior in terms of website-building capabilities. However, the two are very similarly priced, with the exception of Shopify not having a free plan.

If you prefer budget-friendly options, I’d lean towards Square. If you want a platform that gives you greater scalability and options, Shopify is the better option. But it’s a tough call.

Hopefully, this will help you when choosing a commerce solution for your business.